As major container shipping lines consistently bypass the Red Sea to avoid the threat of rebel missile attacks, air cargo volumes are finally getting a boost. Preliminary data now backs anecdotal reports a month ago of businesses shifting some Asia exports for Europe and North America to air transport as a way of avoiding delays.

Positive Signs After Excessive Inventories

Until mid-January, there were few hard signs the airfreight sector was picking off cargo normally booked on ocean vessels transiting the Suez Canal. One option getting more attention is a hybrid sea-air mode, which offers faster transit than ocean shipping at a lower cost than pure airfreight.

Shipping prices have skyrocketed following the Red Sea attacks. Ocean freight rates per forty-foot equivalent unit from China to Europe were up 282% to more than $4,700 since Dec. 1, as of Jan. 19, according to Freightos. Global box rates are significantly higher than pre-COVID levels and continue to climb. The Freightos Baltic Daily Index hit $3,410 on Monday, a 145% spike since the start of the year. And spot rates from Asia to the Mediterranean are 160% higher than a month ago at $6,500 FEU. Even shippers booking space at contract rates are paying more as ocean carriers add emergency surcharges to invoices.

After a normal slump in demand following the holiday shipping rush, which crested in mid-December, airfreight volumes jumped by nearly 25% week over week. Over a two-week timeframe to start the year regional volumes increased 12% and 17%, respectively, from the Asia Pacific and Middle East/South Asia to Europe, according to World ACD. The increases were about 10 points more than the same two-week period in January 2023.

Global air cargo demand currently is up about 3% year over year, led by a 6% gain for Asia exports, continuing the positive trend that began in September and reversed an 18-month softening in airfreight demand — a byproduct of inflation, excess inventories and fewer logistics bottlenecks.

The International Air Transport Association said cargo traffic, which is calculated with a distance multiplier, climbed 8.3% in November, the strongest y/y growth in almost two years. The trade group’s numbers were directionally consistent with earlier figures from private data providers that showed air cargo demand increased 5% during the month.

December was even stronger, with 9% y/y growth boosting spot rates to their highest level in nine months and catapulting the air logistics sector into 2024, according to benchmarking agency Xeneta. Entering 2024, capacity is about the same as 2019 but demand remains 8% lower than before the pandemic. Rates are about 40% higher than pre-COVID levels, mostly because of increased jet fuel and operating costs.

IATA said cargo yields increased 8.9% during the final two months of 2023, an indication that airlines were able to fill their aircraft better.

It should be noted that the comparison comes against a low baseline in 2022, with much of the growth concentrated on a few major trade lanes and driven by e-commerce shipments as consumers opted to buy discount goods online for their Christmas gifts.

IATA predicts cargo demand will rise 4% to 5% year over year after contracting about 3.8% in 2023, but with capacity expected to increase 6% to 7%. Others predict slightly slower growth in both categories. As passenger airlines, primarily in China, reintroduce more flights, the outlook is for yields to drop a further 21% on top of last year’s 32% decline. However, IATA’s forecast came before the Red Sea attacks on shipping were fully understood, and the situation there could easily cause volumes to grow more than expected.

Sea-air alternative to Suez Canal route

The longer the Red Sea risk lasts, the more likely shippers are to divert a portion of their Asia orders from ocean to air carriers. Carriers’ need for vessels to move shipments a longer distance around the tip of Africa is soaking up some capacity and driving up ocean rates. Longer voyages mean vessel schedules for ports are out of sync, creating pockets of congestion in Northern Europe. Carriers may opt to skip some port calls to keep vessels on schedule. And repositioning empty containers back to Asia is taking longer, creating a container shortage at origin and slowing the ability of manufacturers to load the next outbound shipments.

Beyond those considerations, cargo owners need to evaluate the impact on their working capital if they have to increase inventory by several weeks to make up for slower delivery times. Although airfreight can be 13 to 15 times more expensive than ocean shipping, retailers and manufacturers may find it cheaper to move goods by air than to invest in extra inventory.

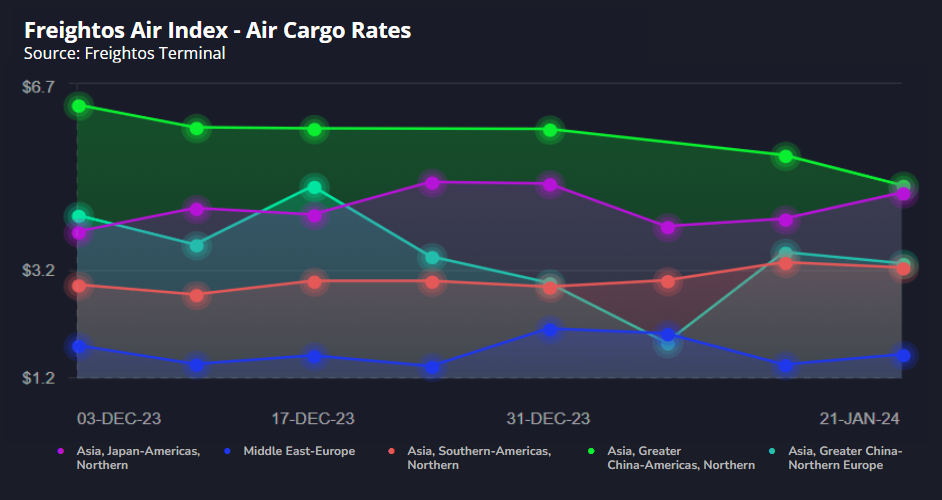

But there are harbingers of firmer pricing in what is normally a slow period. While air cargo rates out of China have sagged since the start of the year, prices from South Asia to North America have increased 12% and rates from the Middle East — a key transshipment point for sea-air options — climbed 13% last week.

Xeneta, another data provider, on Friday said air cargo volumes from Vietnam to Europe — a major trade route for apparel — soared 62% in the week ending Jan. 14. The demand grew 12% on a y/y basis and was 6% greater than in the peak week in October. Airfreight rates on the corridor moved up 10% from the prior week because of extra pressure on capacity.

Rates are also being boosted by the pull forward in shipments in anticipation of Chinese factories closing for the Lunar New Year holiday that begins Feb. 10, experts say.

As the market moves back toward post-pandemic equilibrium, more businesses committed to longer fixed-rate contracts during the last quarter of 2023, Xeneta said. Contracts of six months or more signed with logistics providers or airlines accounted for 73% of total contracts. Shippers are less interested in one-month contracts that are subject to the upward trend in market rates for immediate transactions.

2024 outlook

Although 2024 is shaping up as a better year for air logistics players, there is plenty of uncertainty about the direction of the global economy and retailers’ purchasing behavior. Retailers have completed post-pandemic inventory destocking, but merchandisers are unsure whether consumer strength is ebbing and are cautious about placing overseas merchandise orders. With better tools for tracking consumer demand, many retailers are returning to just-in-time replenishment.

Meanwhile, economists say the full effects of tighter borrowing conditions have yet to fully spread through the global economy even as central banks have mostly stopped raising interest rates. Fitch Ratings is forecasting U.S. growth to fall from a likely 2.5% in 2023 to 1.2% this year, as consumer spending moderates from the pandemic peak and the labor market loosens. China’s economic growth will also fall below 5%, while Europe’s economy is expected to stagnate, especially with Germany hovering near recession.

The World Bank said it expects U.S. growth to decelerate to 1.6% this year and the global economy to go from 2.6% to 2.4%.

Manufacturing in key regions, like Europe, the U.S., China and parts of Northeast Asia,is still slow.

Bruce Chan, senior logistics analyst at Stifel, summed up his guess for the year this way: “IATA forecasts call for approximately 20% y/y declines in global air cargo pricing. Our inclination is that rate declines won’t be quite that bad, but they will likely still be squarely negative as passenger capacity continues to filter into the market. Based on what we see today, a return to annual air cargo rate growth probably won’t happen until 2025, but there is a lot that can happen in that timeframe.”

Source: Freightwaves

For more Articles from Unicorn Global: https://unicornw.com/news-media/news/

Comments1

Collaboratively administrate empowered markets via plug-and-play networks. Dynamically procrastinate B2C users after installed base benefits. Dramatically visualize customer directed convergence without revolutionary ROI.